Editor’s note: TPG founder Brian Kelly is a Bilt adviser and investor.

If you’re a Bilt cardholder, check your email. The renter-favorite rewards program sent out a survey to get feedback on potential upcoming changes to the Bilt card lineup — and there’s plenty to be excited about … especially if you’ve been hoping for a way to earn rewards while paying your mortgage.

When the Bilt Mastercard® (see rates and fees) launched in 2021, it made a splash as the first card that allows renters to earn rewards on rent (up to 100,000 points in a calendar year) without paying a credit card processing fee. From there, the Bilt Rewards ecosystem has only grown, with the card now being just one piece of that larger world.

Looking specifically at the card for now, the chance to earn points on rent was enough to sell a lot of us on it, but that’s not all it offers. It has earning rates similar to the fan-favorite Chase Sapphire Preferred® Card which earns transferable travel points that are currently tied with Chase Ultimate Rewards as the most valuable type of rewards out there, according to TPG’s February 2025 valuations. The biggest difference? The Bilt Mastercard offers these benefits for no annual fee (see rates and fees).

Still, the Bilt Mastercard has received some skepticism in its time on the rewards card scene. With no traditional welcome offer and no real way for those who don’t rent to earn rewards on their housing, some rewards credit card enthusiasts simply haven’t seen the card as worthy of taking up space in their wallets — even though the rewards are quite valuable.

Bilt has been listening and working to create more options for cardholders. And this week, we’re getting a peek into the next step in that process and where Bilt’s plans might be heading.

Are the possible changes in its card lineup enough to make those on the fence jump over, or do they risk alienating those who love the card as it is? Here’s what TPG staffers have to say about the possibilities we saw in the survey.

Survey overview

This week, Bilt emailed cardholders with a survey about possible aspects of a future card (or card lineup).

Richard Kerr, the VP of travel at Bilt Rewards, asserts that these survey questions are in no way a promise of a final product.

“I do want to be clear that these are not locked in options, they are not finalized, they are not rigid, we have not committed to these and there will be many, many more revisions,” he said in an email.

Still, there are plenty of speculative changes laid out in the survey for Bilt members — and those who have been holding out on applying — to have big opinions about as they think about what this valuable program might be able to do for them in the future.

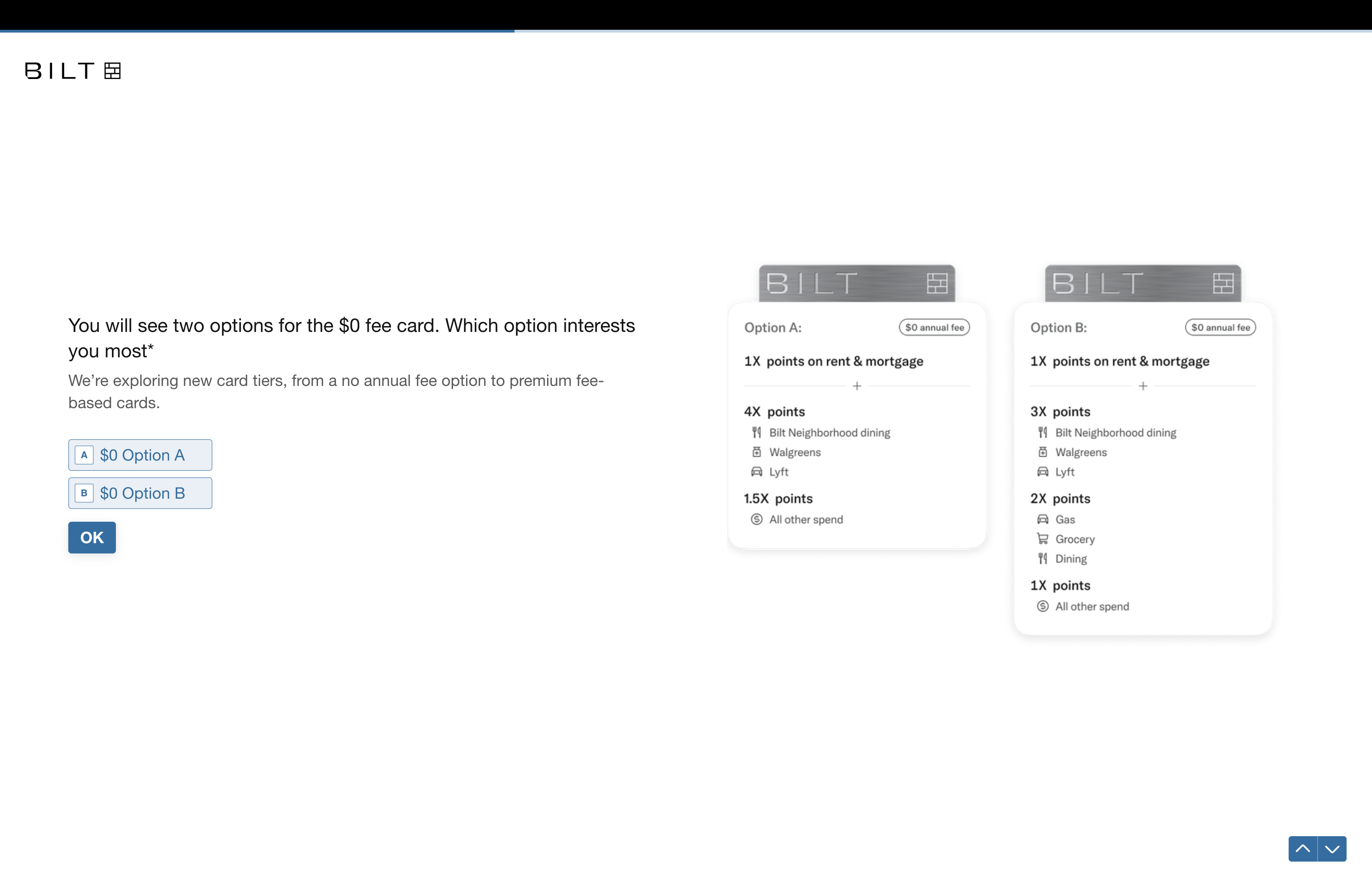

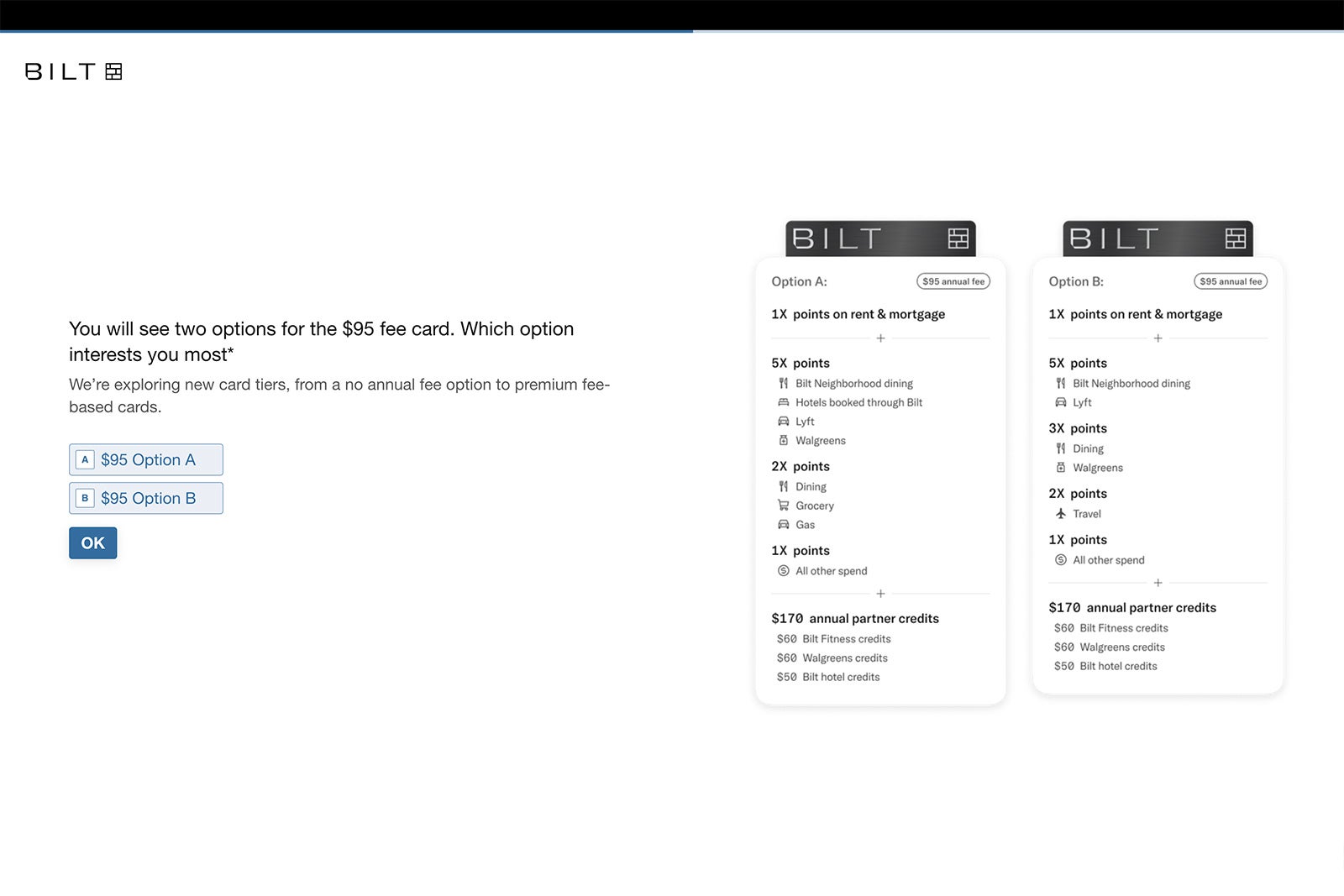

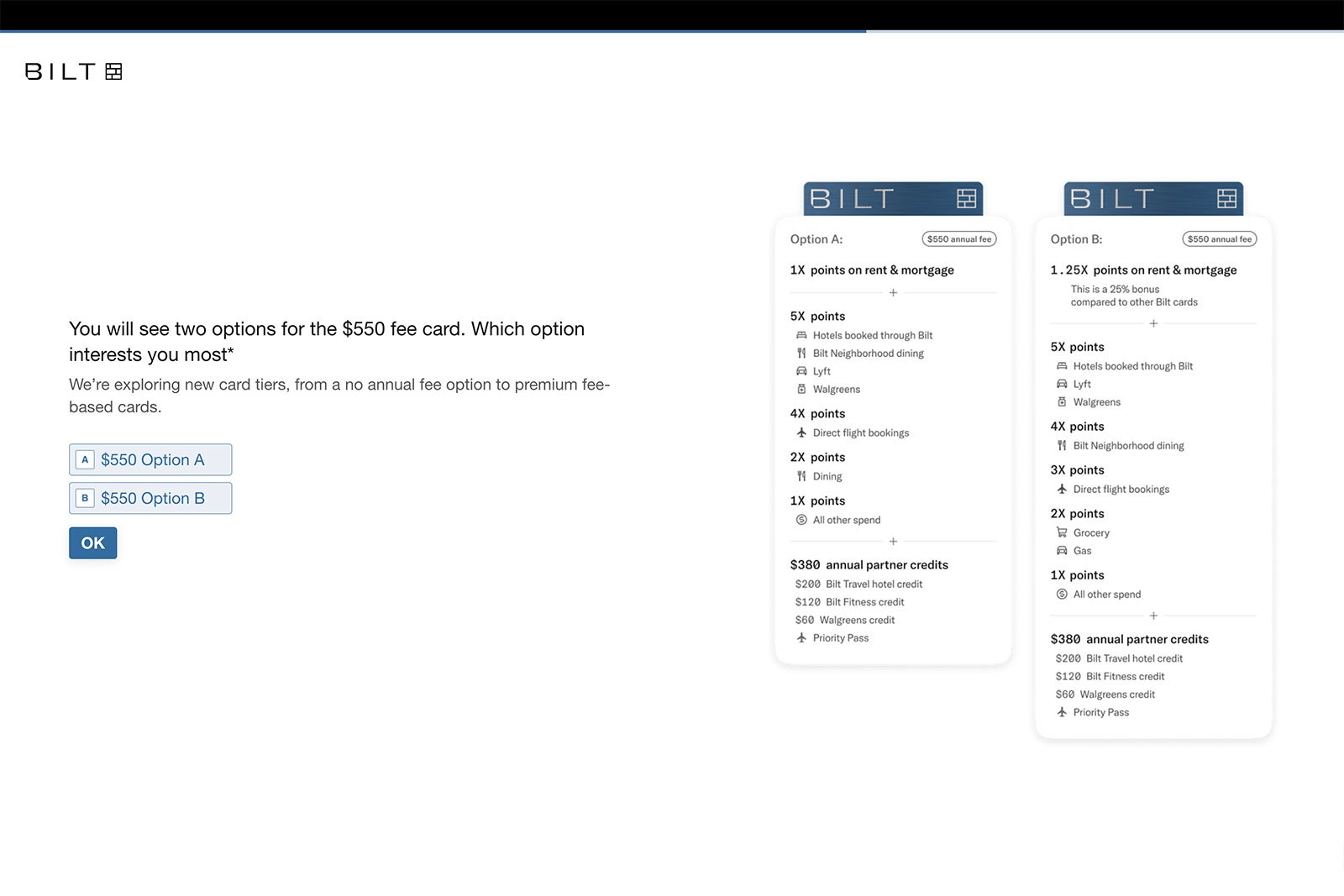

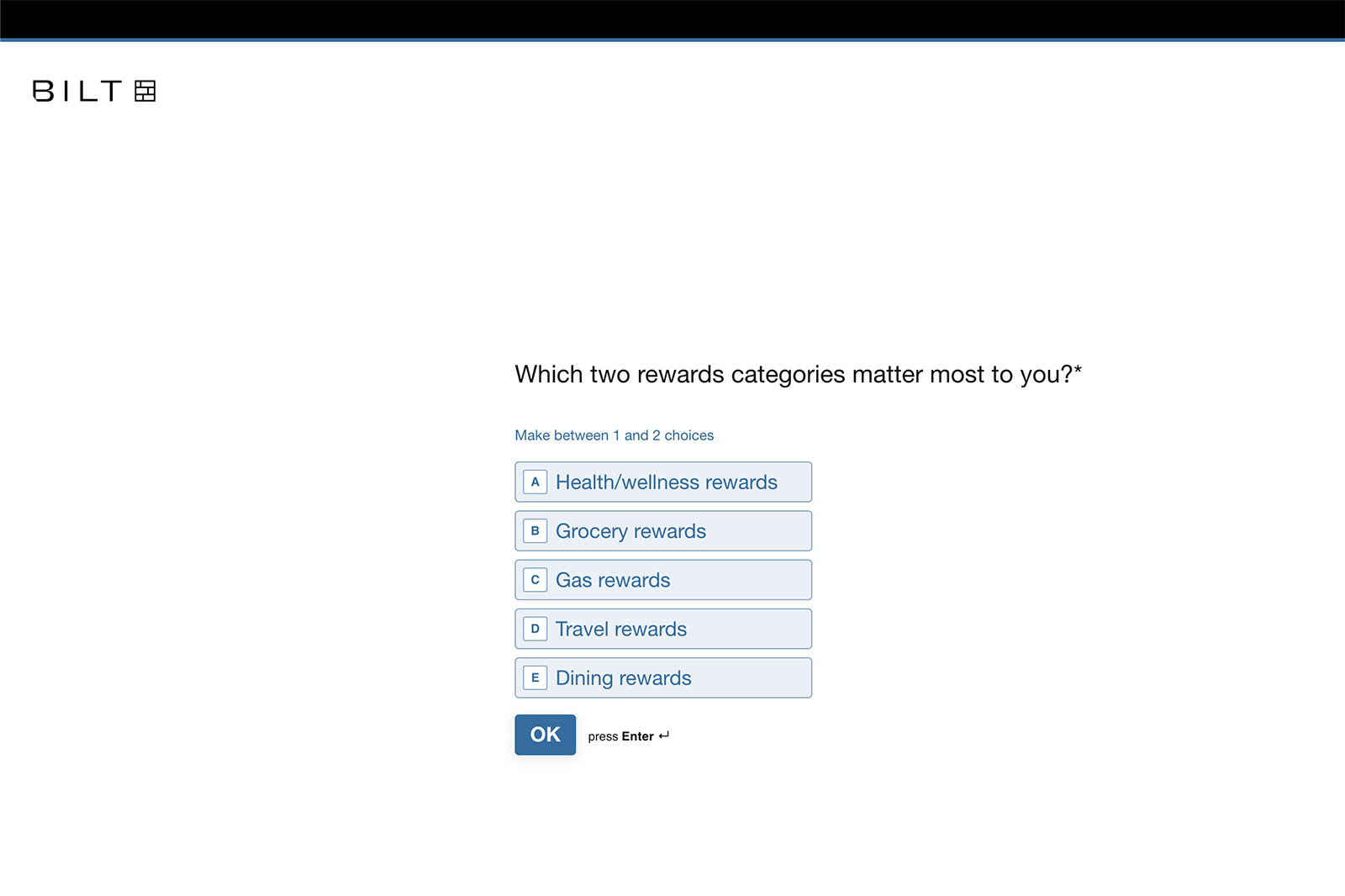

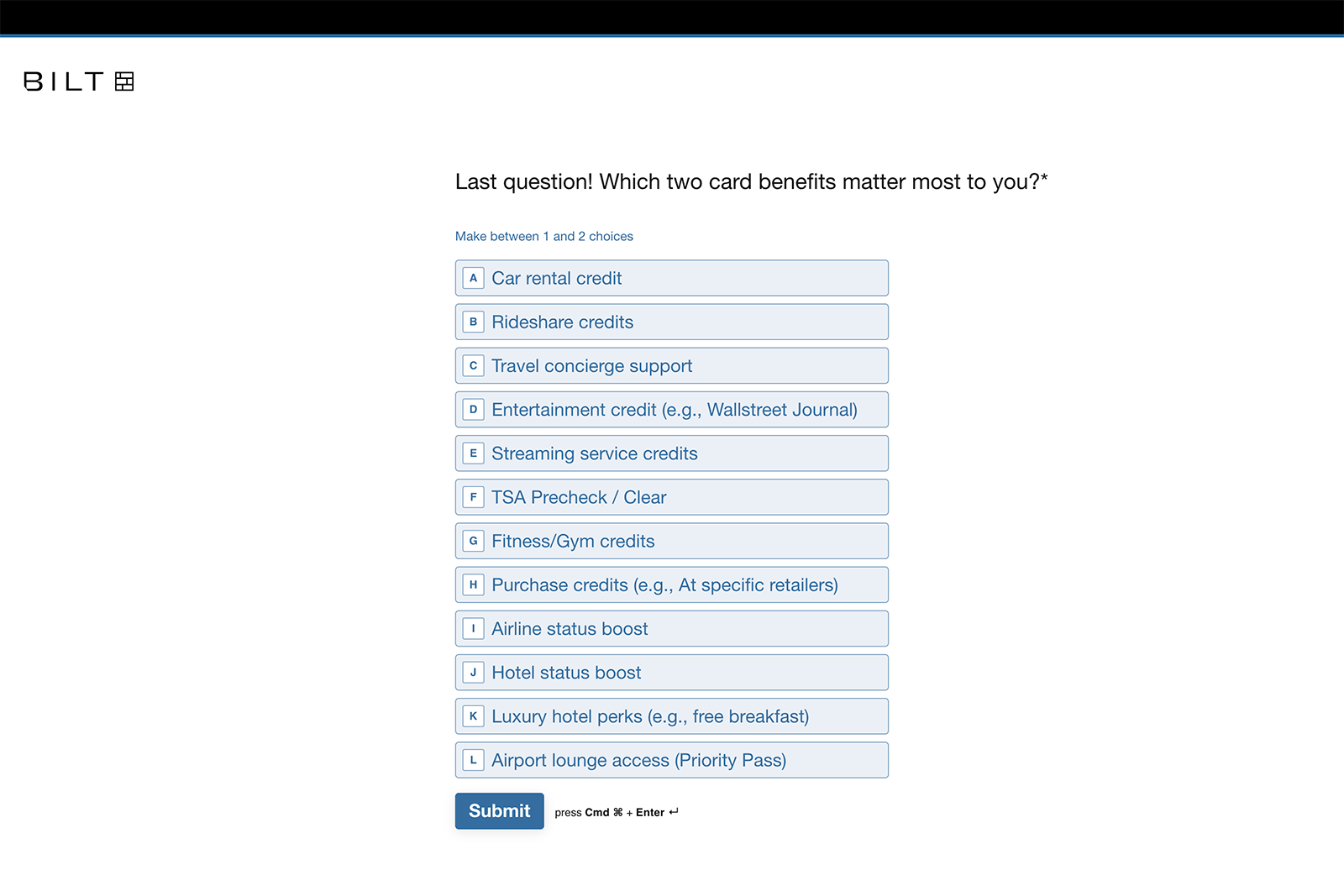

The survey asks cardholders to choose between two versions of three different card tiers: no-annual-fee, $95 annual fee and $550 annual fee. Additionally, it asks cardholders to indicate their preferred rewards categories and card benefits and which cards they currently use as their everyday card if it’s one other than Bilt.

TPG staffers take on Bilt’s survey options

One of our favorite pastimes at TPG is to analyze potential changes in a credit card or rewards ecosystem. When we saw the possibilities outlined in Bilt’s survey, we wasted no time debating the merits of each option and playing the role of rewards card consultant for the day.

Mortgage rewards

At TPG, the most cited reason for not yet holding the Bilt Mastercard is that it doesn’t offer benefits for mortgage holders. While not a guaranteed future card benefit, the inclusion of points-earning for mortgages across every option listed in the survey is a great sign for homeowners who fork out thousands of dollars per month in that spending category.

Could we really be on the cusp of unlocking a good way to earn valuable rewards on such a huge amount of monthly spending? If so, that will likely be one of the biggest stories in rewards currencies of the entire year. If this could really happen, the Bilt Rewards program could get dramatically more interesting for many in the TPG hallways.

Still, some of us are a little skeptical of the devil that could lurk in those details.

TPG managing editor Erica Silverstein is interested in getting one of the Bilt cards — as long as mortgage holders aren’t charged the processing fee. Similarly, we’re interested to see if all mortgages will be eligible to earn rewards or if there will be restrictions such as limitations on eligible mortgage providers or requirements of certain tier levels within the Bilt program that will continue to keep many from earning rewards on their mortgage payments in a way that makes financial sense for them as the cardholder.

Earning rates

The earning rates listed in this survey are possibly the most divisive potential changes to Bilt’s card lineup.

Personally, I love the current earning structure of 3 points per dollar spent on dining and 2 points per dollar spent on travel purchases (the card must be used five times each statement period to earn points; see rewards and benefits), and I was disappointed not to see an option to keep these earning rates on any of the survey options. Similarly, TPG managing editor Madison Blancaflor was disappointed to see more restrictive bonus categories in the survey options, such as limiting dining bonus-earning to Bilt Neighborhood Dining rather than general dining purchases.

One of the no-annual-fee options includes an earning rate of 1.5 points per dollar for all nonbonus spending, which TPG director of content Carly Helfand shared she is the most excited about. She currently uses her Chase Freedom Unlimited® card to earn 1.5 points per dollar on nonbonus spending but would prefer to earn Bilt Points at that rate if given the option since Bilt points post to her account quicker than her Chase Ultimate Rewards points.

TPG copy editor Will Gordon loves the idea of earning 1.25 points per dollar spent on rent or mortgage payments, which is listed as one of the premium card options on the survey. Still, many of us wouldn’t get enough value from that additional earning by itself to justify a premium annual fee over the 1 point per dollar level offered on lower fee cards without getting unique value from other earning categories.

Related: The best rewards credit cards for each bonus category

Statement credits

Both the mid-tier and premium card options included statement credits for Bilt Travel hotels, Bilt Fitness and Walgreens.

For those who don’t mind adding to their stack of statement credits they already need to remember, the Bilt hotels and Walgreens credits seem easy enough to redeem. For those who have expensive prescriptions that they can fill through Walgreens, that credit could be a real asset.

I am among the many cardholders who don’t have Bilt Fitness options near me, so I could only take advantage of those credits when I’m traveling. This could prevent some prospective applicants from getting full value from any of the annual fee card options.

Hopes and fears

In addition to what we see in this survey, many of us have hopes and fears about things that aren’t directly addressed.

For instance, a major hurdle to justify adding the Bilt Mastercard to our wallets has been that it doesn’t come with a traditional welcome offer. While it seems reasonable to hope for one on new cards with higher annual fees, Bilt has not officially commented on whether a welcome offer is part of the conceptual plans for these new cards. This could be a major factor in the decision to get any of the new Bilt cards, especially at the higher tiers.

Additionally, there’s no indication of exactly how the mortgage earning rate is structured, so it’s hard to peg a true value on that.

Finally, would these new products impact any of Bilt Rewards’ current offerings? Right now, you must make at least five purchases a month to earn points on rent (see rewards and benefits) — would this be updated with a more diverse card portfolio? And existing cardholders (like me) sure love the current Rent Day promotion that allows us to earn double points on all purchases on the first day of the month. If these cards do come to market, it’ll be interesting to see how they interplay with the current value proposition of the program.

Related: Bilt’s Rent Day promotion

Game changer or not?

So the question remains: Are these potential changes a game changer for those who have thus far been on Bilt’s sidelines? Could the addition of earning points on mortgages become one of the biggest and most exciting stories of 2025?

In short, it depends. In some ways, the possible changes outlined in the survey could be good news for those who are newer to the rewards credit card space and looking for an all-in-one rewards card. The earning rates at each level offer a decent return for many cardholders, and the benefits outlined appear to be relatively straightforward.

However, the general consensus among TPG staffers specifically is that we would still opt for a no-annual-fee version of the card rather than shell out for one of the premium products we saw in the survey as they were being presented. Other than earning rewards on housing payments, most of us have other cards with similar or better earning rates and benefits, and the appetite for managing more statement credits wasn’t high.

Our senior vice president of content Jamie Page would rather see Bilt offer bonus earnings on home-related purchases, such as plumbing or electrician services, insurance, lawn crews and hardware stores.

TPG senior director of content Summer Hull agreed, saying, “What I really want from a Bilt card is something different you can’t replicate elsewhere … not just a card of a different color.”

Bottom line

Bilt Rewards has done some incredibly exciting things in the last few years, so there’s a lot of buzz about the potential for that trend to continue and expand.

But while these possibilities are fun to consider as Bilt surveys its cardholders about potential new card products, it’s too soon to get too worked up — positively or negatively — about any of them. Bilt has stressed that these are far from guarantees, promising only that future card products will undergo multiple revisions. But it is a great time to fill out that survey and let Bilt know what you want to see. We are certainly doing the same over here.

For more details on the current Bilt card, check out our full review of the Bilt Mastercard.

Apply here: Bilt Mastercard

See Bilt Mastercard rates and fees here.

See Bilt Mastercard rewards and benefits here.

Editor’s note: TPG founder Brian Kelly is a Bilt adviser and investor. If you’re a Bilt cardholder, check your email. The renter-favorite rewards program sent out a survey to get feedback on potential upcoming changes to the Bilt card lineup — and there’s plenty to be excited about … especially if you’ve been hoping for …

![[removal.ai]_41709505-b305-44fd-97ff-5c381de50796-soccer-review-hub-1](http://soccerreviewhub.com/wp-content/uploads/2023/09/removal.ai_41709505-b305-44fd-97ff-5c381de50796-soccer-review-hub-1-1-e1694514490671.png)